Highlights from Nova Scotia Provincial Budget 2024-2025 – Impact on Construction Industry

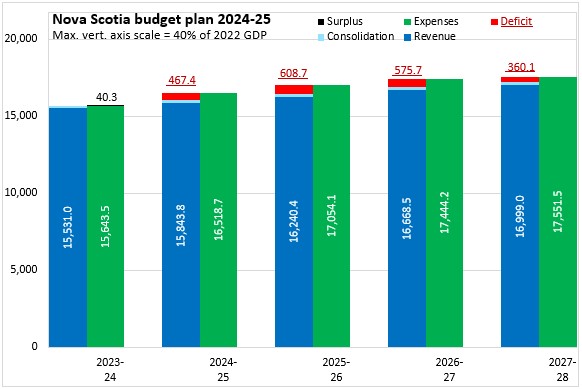

Earlier today, the Government of Nova Scotia released Budget 2024-25, including $1.6 billion for capital projects. With revenues of $15.8 billion and expenses of $16.5 billion, Budget 2024–25 estimates a deficit of $467.4 million (after consolidation and accounting adjustments).

The deficit is projected to widen to $608.7 million in 2025-26 before narrowing to $575.7 million in 2026-27 and $360.1 million in 2027-28.

Nova Scotia’s revenues are projected to grow by 2.0% from the 2023-24 forecast to the 2024-25 budget estimate while expenditures grow by 5.6%. In 2025-26 revenue growth is projected to quicken to 2.5% while expenditures grow by 3.2%. In 2026-27, revenue growth of 2.6% exceeds expenditure growth of 2.3%. In the last year of the 2024-25 fiscal plan, revenue growth (+2.0%) again outpaces expenditure increase (+0.6%).

Budget Highlights:

Supporting Nova Scotians and Building Communities —

- Beginning January 1, 2025, indexing personal income tax brackets, the basic personal amount and certain non-refundable tax credits to Nova Scotia’s inflation rate. It will be the largest tax break in the province’s history and will save Nova Scotians about $150- $160 million per year in taxes by 2028.

- $84.6 million for initiatives under the Supportive Housing Action approach and other programs to address homelessness, including: a 100-bed shelter in Dartmouth, a 70-bed shelter in Halifax, and a new shelter exclusively for 2SLGBTQIA+ clients in Halifax

- $9.6 million toward the plan to build 5,700 new and replacement long-term care spaces by 2032

- Capital Plan 2024–25 includes $579 million to advance new healthcare redevelopment projects and fund other projects that will improve the healthcare system.

- $301.7 million for Halifax Infirmary expansion and Cape Breton Regional Municipality healthcare redevelopment projects

- $16.5 million for transition-to-community centres

- $108.3 million for construction and renewal of other hospitals and medical facilities, including projects in Amherst, Pugwash, Bridgewater, Yarmouth and the IWK Health Centre

- $32 million to repair and replace medical equipment

- $22 million to repair and replace medical facilities

- $20.2 million for various Action for Health plan capital initiatives

Building a Skilled Workforce —

- $46.4 million this year to make progress on the province’s $100 million plan to grow the skilled trades workforce over the next three years

- $671,000 to increase participation and retention of women working in the skilled trades and to help advance women in their apprenticeships, in partnership with the federal government

- $27.2 million for the More Opportunity for Skilled Trades (MOST) tax refund program for workers under the age of 30 in high-demand occupations, including skilled trades, film and video occupations. Starting in the 2023 tax year, MOST is expanding to include eligible nurses.

More Housing, Faster —

- $8.6 million this year for community-based settlement service organizations that support newcomers

- $80-$100 million estimated annually to rebate the 10% provincial HST on the new construction of purpose-built, multi-unit apartments

- $14.8 million this year for Nova Scotia projects to leverage funding from the National Housing Strategy 2022-25 Action Plan

- $5 million to expand the $28.6 million Affordable Housing Development Program to include student housing project proposals

- $3.6 million for a rapid housing initiative to develop new affordable housing units in Halifax

Building a Clean, Healthy Economy —

- $5.5 million more, for a total of $23.4 million, for the Payroll Rebate Program, which provides incentives to attract innovative companies to the province and create jobs

- $12 million for the Innovation Rebate Program, which provides incentives for businesses to invest in their operations and become more innovative, productive, competitive and sustainable

- $14.1 million for the Capital Investment Tax Credit, a refundable corporate tax credit that can be claimed for capital equipment and property for use in Nova Scotia and recently expanded to include emerging sectors like aerospace and manufacturing

2024-2025 Capital Plan —

- $483.3 million for major 100-series highway construction projects, and repaving and structure work (Capital Plan)

- $35.3 million to build new public housing units and for more repairs and maintenance to existing public housing (Capital Plan)

- $11.8 million for a new investment in modular public housing (Capital Plan)

- $27.1 million for NSCC student housing projects at various stages of development (Capital Plan)

Resources for Budget 2024-25

Find more information and access budget documents including the budget address, highlights, bulletins, estimates, business plans and other supporting documents for the 2023 to 2024 fiscal year. Click here to access resources for Budget 2024-25.